Politics

April 18, 2024, 19:39

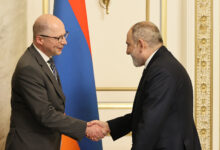

Armenian PM, French Co-Chair of the OSCE Minsk Group discuss regional processes

Politics

April 18, 2024, 16:56

Prime Minister Nikol Pashinyan received Brice Roquefeuil, Head of the Directorate for Continental Europe of the Ministry for Europe and Foreign Affairs…

In a new report, the Council of Europe’s Group of States against Corruption (GRECO) calls on Armenia to pursue its efforts to prevent corruption in respect…

Prime Minister Nikol Pashinyan received Martin Shtikel, the executive director of the German Fichtner company operating in the energy sector,…

In an op-ed for Le Monde, former NATO Secretary-General, Anders Fogh Rasmussen, calls on Brussels to move beyond its policy…

The EU has agreed to expand sanctions on Iranian producers of drones and missiles following Tehran’s attack on Israel, the…

The Academy Museum of Motion Pictures is set to screen Sergei Parajanov’s beloved film “The Color of Pomegranates,” as well…

The hard rock band Kiss has sold its back catalogue of songs to a Swedish music investor for a figure…

Henrikh Mkhitaryan feels that the chance for Inter Milan to clinch the Serie A title against AC Milan is “crazy” and “historic.”…

A pillar of the Nerazzurri midfield, Henrikh Mkhitaryan has featured in every single one of Inter’s 32 league games so…